AVAILABLE FOR RENT: 3/2/DR/1-Car, Redwood City, reduced to only: $4750/ mo.

One-of-a-kind home! This could be YOUR new home! Not a typical rental! Designed and built with your needs in mind. AND the monthly rent has been reduced to $4,750/mo.

If you want to lease a “home” instead of one of the many “rentals” you have seen recently then this is the place for you. 708 Hudson Street in Redwood City is the place to live because it has gone through a complete renovation with no expense spared. Which means only the highest quality material and craftsmen were used during all steps of the refurbished process.

GREAT CREDIT IS A MUST!!!

708 Hudson Street – Redwood City, CA 94061

Rent: $4,750.00 per month

Security Deposit: $ 6,000.00, which is fully refundable if returned with only “ normal wear and tear”. Last two tenants both got their full security deposits back! I want to return your Security Deposit back to you because it makes my job easier, and the property will have been well care of by you as any home should be.

This spacious 1560 sq. ft. 3-Bedrooms, 2 Full Baths, Dining Room, and 1-Car Garage with extra storage cabinets for your belongings. You know, items like snow skis and warm winter clothing for the slopes.

For a real treat, included is your own private clothes washer and dryer. No more extra wet and dirty clothing hanging about or having to search for quarters for the laundromat.

Features:

- Bright recessed (LED) spotlights and the airy 1560 sq. ft. home with golden Hickory laminate floors in the Living Room, Dining Room, and Hallways.

- Modern Kitchen with granite countertops, custom designed tiled floors, LED recessed lights, and a spacious pantry.

- Low pile carpet in the Bedrooms with LED recessed lighting.

- Master Ensuite Bedroom, with stone countertops, double sinks, shower-over-tub, and custom tile bathroom floors. LED recessed lighting.

- Hall bath has a white wood vanity and medicine cabinet, and granite countertop, modern LED lighting over sink and ceiling, a roomy floor to ceiling linen closet, shower-over-tub, and custom tile floors. Recessed LED spotlights making for a bright Hall Bathroom.

- Additionally, crown molding, recessed LED lighting throughout including dimmer switches, and an inside mirrored skylight in hallway. Fenced back patio, and drought tolerant front yard. Herbs, Avocado, and Citrus Tree.

- Security LED exterior lighting with motion sensors.

- This property was completely remodeled in 2009, 2017, 2024 and won the Mayor’s Beautification Award!

——— Prefer No Animals Please ————

Cliff Keith, Owner/Realtor DRE #00605874

Cell: (650) 346-7366 – cliff@sfbayhomes.com

Delightful Duplex with modern updated features that will satisfy the most discerning tastes.

- 3 Bedrooms-including a “Primary Ensuite”

- 2 Bathrooms both with Showers over Tubs

- Dining Room with sliding doors to exterior fenced back yard and separate rear entry.

- 1560 square feet living space. A lot of square-footage compared to other homes for rent.

- 8 Rooms total plus 1-Car Garage

- The 1-car garage includes extra storage cabinets, and a private clothes washer and dryer system.

- Available Now

For more information:

Email or call:

Cliff@sfbayhomes.com or call (650) 346-7366 to arrange a showing of this wonderful home.

(Please include your name and your email address and Phone number because it would be helpful.)

I will try to be on the property most days to be available for those too busy to set an exact time. Look for my 4-door, white Nissan. That means I’m there and you may see the property without an appointment.

**$4,750.00/month

**Includes weekly gardener and quarterly pest inspection and servicing.

**Security Deposit: $6,000 Fully refundable provide property is left the way you got it when you moved in. CAR’s MIMO form will be use.

**Available: Now

******* Great Credit A Must! *******

***** Pet breed and size restrictions *****

FOR RENT: 3/2/DR/1-Car, Redwood City, $4950/ mo.

One of a kind home! This can be YOUR home! Not your typical rental! Designed and built to your needs.

If you want to lease a “home” instead of one of the many “rentals” you have seen recently then this is the place for you. 708 Hudson Street in Redwood City is the place to see, because it has gone through a complete renovation with no expense spared. Which means only the highest quality material and craftsmen were used during all steps of the refurbished process.

GREAT CREDIT A MUST!!!

708 Hudson Street – Redwood City, CA 94061

Rent: $4,950.00 per month

Security Deposit: $ 6,000.00, which is fully refundable if returned with only “ normal wear and tear”. Last two tenants both got their full security deposits back! I want to return you your Security Deposit because it makes my job easier and the property will have been well care for by you as a home should be.

Spacious 3-Bedrooms, 2 Full Baths, Dining Room, and 1-Car Garage with extra storage cabinets for your belonging you use only during a season. You know like snow skis and warm winter clothing for the slopes.

For a real treat, included is your private clothes washer and dryer. No more extra wet and dirty clothing hanging about, or having to search for quarters for the laundromat.

Features:

- Bright (LED) recessed spot lights and airy 1560 sq. ft. home with golden Hickory laminate floors in the Living Room, Dining Room, and Hallways.

- Modern Kitchen with granite countertops, custom designed tiled floors, LED recessed lights, and a spacious pantry.

- Low pile carpet in the Bedrooms with LED recessed lighting.

- Master Ensuite Bedroom, with stone countertops, double sinks, shower-over-tub, and custom tile bathroom floors. LED lighting recessed.

- Hall bath has a wood vanity and medicine cabinet, with granite countertop, LED lighting over sink and ceiling, a roomy floor to ceiling linen closet, shower-over-tub, and custom tile floors. Recessed LED spot lights

- Additionally, crown molding, recessed LED lighting throughout along with dimmer switches, and a inside mirrored skylight in hallway. Fenced back patio, and drought tolerant front yard. Herbs and Citrus Trees.

- Security LED exterior lighting with motion sensors.

- This property was completely remodeled in 2009, 2017, 2024, and won the Mayor’s Beautification Award!

——— Prefer No Animals Please ————

Cliff Keith, Owner/Realtor DRE #00605874

Cell: (650) 346-7366 – cliff@sfbayhomes.com

Wonderful Duplex with updated features that will satisfy the most discerning tastes.

- 3 Bedrooms-including a “Primary Ensuite”

- 2 Bathrooms both with Showers over Tubs

- Dining Room with double sliding doors to exterior back yard.

- 1560 square feet living space

- 8 Rooms total plus 1-Car Garage

- The 1-car garage includes extra storage cabinets, and a private clothes washer and dryer system.

- Available Now

For more information:

Email to cliff@sfbayhomes.com to arrange a showing so you can see this wonderful home soon.

Include your name and your email address. Phone number because it would be helpful.

I will try on most days to be available on the property around 1:00 – 1:30 pm for those who have limited availability.

**$4,950.00/month

**Includes weekly gardener and quarterly pest inspection and servicing.

**Security Deposit: $6,000

**Available: Now

*******Great Credit A Must!*******

*****Pet breed and size restrictions*****

Real Estate Loan Pre-Approval

Buying a home is one of the biggest financial decisions you will make in your lifetime. For most people, it’s not something they can just pay cash for. Instead, they need to get a real estate loan. However, before you start shopping for a new home, you need to get pre-approved for a mortgage. Pre-approval is the process of getting a preliminary commitment from a lender for a mortgage loan before you find the home you want to buy. Here are the steps to getting pre-approved for a real estate loan:

Step 1: Check Your Credit Report

The first step to getting pre-approved for a mortgage loan is to check your credit report. Your credit score is one of the most important factors lenders consider when determining your eligibility for a loan. You can obtain a free copy of your credit report once a year from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. Review your credit report carefully and make sure there are no errors or inaccuracies that could negatively affect your credit score.

Step 2: Gather Your Financial Information

When you apply for a mortgage loan, you will need to provide a lot of financial information. Start gathering the following documents:

– W-2 forms for the past two years

– Pay stubs for the past two months

– Bank statements for the past two months

– Tax returns for the past two years

– Proof of any additional income (such as alimony or child support)

Step 3: Choose a Lender

Once you have your financial information in order, it’s time to start looking for a lender. You can choose to work with a bank, credit union, or mortgage broker. It’s a good idea to get quotes from several different lenders to compare interest rates and fees.

Step 4: Get Pre-Approved

Now that you have chosen a lender, it’s time to get pre-approved for a mortgage loan. The lender will review your financial information and credit score to determine how much they are willing to lend you. They will also provide you with a pre-approval letter, which you can use to show real estate agents and sellers that you are a serious buyer.

Step 5: Find Your Dream Home

With your pre-approval letter in hand, you can start shopping for your dream home. Keep in mind that your pre-approval letter is not a guarantee of a loan. The lender will still need to review the property and your financial information before finalizing the loan.

Step 6: Finalize Your Loan

Once you have found a home you want to buy, it’s time to finalize your loan. The lender will review the property and your financial information to ensure that you meet their requirements. They will also order an appraisal of the property to determine its value. If everything checks out, the lender will give you a loan commitment letter, which means that they are willing to lend you the money to buy the home.

Step 7: Close on Your Home

The final step in the process is to close on your home. This is when you sign all the paperwork and officially become the owner of the property. You will need to bring a cashier’s check or wire transfer for the down payment and closing costs. Once everything is signed, the keys are yours!

In conclusion, getting pre-approved for a real estate loan is an important step in the home buying process. By following these steps, you can make sure you are prepared and have the best chance of getting approved for a mortgage loan. Remember to shop around for the best interest rates and fees, and to keep your credit score in good shape. With a little bit of preparation, you can make your dream of homeownership a reality.

- Cliff Keith – Vietnam Combat Veteran

- (650) 346-7366 Text or Direct line

- Cliff@SFBayHomes.com

The 5 Items To Study Before Writing An Offer To Purchase Your New Home.

Yes you can write an offer on the home you just love and want to buy. You may save yourself lots of time and money if you take a few steps prior to writing your offer. There will be less stress in your life if you do. What are the 5 things to investigate when writing an offer?

When you get ready to place an offer on a home you should do 5 things first and then structure your offer so. By doing so you will have a better picture of your future neighborhood, community and neighbors. This is not the time to skip this step only to find out this information after you have closed your escrow. Those five things to research are as follows:

1. Job Stability:

You can research this at www.bls.gov If there are no jobs how will you be able to pay your mortgage payments?

2. Recent Sales Activity:

Although, what homes in the area have sold for is very important, Sales Volume equally is important. It shows if homes buyers want to live in a particular area of town you are considering or not. If no one wants to live there why would you want to live there?

3. Number of Building Permits:

This registers the active builder’s sentiments and future housing activity. It stands to reason, for people who make their living from selling homes, they would NOT put their money in an area if they didn’t think they couldn’t make a profit down the road.

4. Where is the best money?:

Where can you find the best home loan for your needs? Is it better at a local bank? A credit union? Maybe the current “Big 4” institutional lenders is the answer. Get on the phone and dial for dollars to find the answer.

5. Anecdotal Evidence:

Home buyers can easily find homes that are for sale online or driving around on Sunday afternoons. A resource a home buyer has available to them for local ability and guidance is the area Realtor. A Realtor not only gathers facts to your particular needs but also has knowledge of some home before they have a chance to be entered into the MLS. Realtors will help shorten your real estate learning curve.

Benefits the homebuyer:

Using these 5 actions items to help you buy a home are invaluable to you. They will aid you in making the best decision possible when buying your new home. A little research on the homebuyer’s part will make their transition into a new home easier. Homebuyers will find having fewer hurdles to jump during their home buying process.

Good luck on your home search. These are exciting times for you.

Click for (Free MLS) select your City of interest you will be sent to a list of homes.

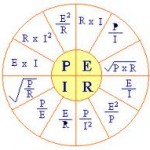

How much home can I buy? Here’s a simple formula I learned some 36 year ago for figuring out what someone may afford when buying their new home.

Take your Gross Income, multiply it times 40%, divide by 12, and that will be your monthly payment you would qualify for from the bank. (This is if you have good credit and is only a ball park estimate.) The interest rate factor for 5% is $5.37. I know there is cheaper money out there but this will give you a good general idea. If you want to know another interest rate factor go to the internet and type in the words “amortization table”, look at what the figure is for $1,000 under the interest rate you want a factor for and use that number as your interest rate factor. How much home can I buy?

What is the formula for knowing the price of the home I can buy?

Here’s an example: Your Gross Income is $50,000: multiple by 40% = $20,000 divide by 12 = $1,666.66/month divide by interest rate factor $5.37 for 5% = $310,366.21. Now add your down payment to that number and you will know what you can buy using a loan from a Conservative lender. Again this is a ballpark method and only gives you an educated idea of what you might be able to buy. Remember this does NOT include any closing costs you may incur during your escrow period.

If you would like to know more information or better understand the home buying process. I would be happy to talk with you and answer any of your questions. In the meantime here are a few reports that may help you on your journey of buying a new home. http://www.sfbay-homes.com/buying/index.cfm?page_ID=48169

What is the formula for knowing the price of the home I can buy? For further help email, or call me. I am here to help you. How much home can I buy?

The 5 Items To Study Before Writing An Offer To Purchase Your New Home.

Yes you can write an offer on the home you just love and want to buy. You may save yourself lots of time and money if you take a few steps prior to writing your offer. There will be less stress in your life if you do. What are the 5 things to investigate when writing an offer?

When you get ready to place an offer on a home you should do 5 things first and then structure your offer so. By doing so you will have a better picture of your future neighborhood, community and neighbors. This is not the time to skip this step only to find out this information after you have closed your escrow. Those five things to research are as follows:

1. Job Stability:

You can research this at www.bls.gov If there are no jobs how will you be able to pay your mortgage payments?

2. Recent Sales Activity:

Although, what homes in the area have sold for is very important, Sales Volume equally is important. It shows if homes buyers want to live in a particular area of town you are considering or not. If no one wants to live there why would you want to live there?

3. Number of Building Permits:

This registers the active builder’s sentiments and future housing activity. It stands to reason, for people who make their living from selling homes, they would NOT put their money in an area if they didn’t think they couldn’t make a profit down the road.

4. Where is the best money?:

Where can you find the best home loan for your needs? Is it better at a local bank? A credit union? Maybe the current “Big 4” institutional lenders is the answer. Get on the phone and dial for dollars to find the answer.

5. Anecdotal Evidence:

Home buyers can easily find homes that are for sale online or driving around on Sunday afternoons. A resource a home buyer has available to them for local ability and guidance is the area Realtor. A Realtor not only gathers facts to your particular needs but also has knowledge of some home before they have a chance to be entered into the MLS. Realtors will help shorten your real estate learning curve.

Benefits the homebuyer:

Using these 5 actions items to help you buy a home are invaluable to you. They will aid you in making the best decision possible when buying your new home. A little research on the homebuyer’s part will make their transition into a new home easier. Homebuyers will find having fewer hurdles to jump during their home buying process.

Good luck on your home search. These are exciting times for you.