Home-buyers should never break these 5-rules when buy their new home. There is no guarantee that home prices have hit bottom yet or if there is a real estate bubble on the horizon – but that doesn’t mean that you can’t get a great deal today either. The real estate market is still going upwards but how long will this trend continue? Below are 5 rules of home buying that will help you make sure you do the right thing when buying a home.

Rule 1: NO ONE can time the top or bottom of any market.

Face it: The house you purchase today could be worth less next year. That could get you thinking about not buying today and just wait and see if you can time the bottom. Resist. It’s harder to know when a market has hit the bottom than you may think, and this current real estate market is the best buyers have had it in twenty years. Buyers have a greater choice of inventories of homes and mortgage rates are still cheap! It also looks as the rates are going to continue to stay affordable in the foreseeable future. (Historically, interest rates for real estate stay within the 6%-8% range.)

What should you do when buying a home?

Pace yourself, find the perfect home that suit all of your requirements or at least most of them and then negotiate a win-win acceptable offer: Ignore the seller’s asking price and bid what you are willing to pay based on data you have gotten from your real estate broker. S/he should give you a Comparative Market Analysis (CMA) for every property you put an offer in on. If the seller refuses to budge on your offer, simply move on to the next home that you will find that is right for you.

Remember that if you’re trading up from your first home, your home too could sit unsold because other home buyers will use this same strategy. So sell your present home first before you try to buy your move-up home.

Rule 2: Mortgage rates is strongest reason to buy real estate today!

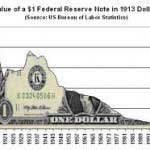

Homes will continue to come on the market for sale, but financing will be getting more expensive with higher interest rates and harder to qualify for with new underwriting guidelines. True, the Federal Reserve has slashed interest rates as far down as they are going to go, but fixed mortgages don’t directly follow the Fed. They show the bond market’s expectations about inflation, which remains a concern. For example, the 30-year jumbo fixed rate is now at 5.5%.

That means there could be a penalty for waiting to buy your next home, even if home prices fall. Today a 4.00% 30 year fixed loan on $250,000 would cost you about $1,200 a month. At 6.00%, that same loan would cost you about $1500. That’s $300 per month or 3 extra payments per year in costs to you. As for a variable-rate loans (ARM), the spread on the interest rate charged by banks between conforming ARMs and fixed rate loans is too narrow to do you much good.

Rule 3: Another reason to buy – rates on big mortgages

Mortgages more than $417,000 – (the limits for buying by federally sponsored mortgage agencies) – usually run a fifth of a percentage point above conventional products. Investors are shunning jumbo loans because of past performance and higher risk, which now average 6.2% and are unlikely to drop.

Certain jumbo borrowers could get relief, however. A new law allows Freddie Mac and Fannie Mae to buy loans as large as $729,750 in 71 high-priced areas. So far “jumbo conforming” loans average 6.0%. The program has gotten off to a slow start; you’ll need to shop around to find the best available rate today.

Rule 4: Don’t buy cheap; buy good schools and neighborhoods

You’ve probably heard from a friend who has a friend who got a great deal on a home that was foreclosed on by a lender. Buying a house includes buying into a neighborhood. Foreclosures are usually found in questionable areas where in the past homeowners and speculators took out exotic mortgages. They later discovered they couldn’t afford their home and the rents would not cover the monthly payments due the bank. That’s not a recipe for a neighborhood with stability. Prices, quality of life and neighborhood conditions could decline further in small areas. Similarly, avoid some of the developments that popped up recently. They too likely have a number of homeowners with risky loans and little equity. Instead, go for areas with highly rated schools. They tend to fare far better off during any future downturns.

Rule 5: Work only with an agent who has your best interest at heart – Beware of Commission Breath!

The real estate business is one with two sides, like a coin. One side wants the most money for their product (house), and the other side wants to pay the lowest price possible this creates a built-in conflict of interest. Also known as an advisory position. Make sure your agent is your advocate and knows what is most important to you in finding and acquiring your new home. A good honest knowledgeable agent is worth their commission ten times over. If you are going to spend the most amount of money you probably will throughout your like then to hire a great agent to represent your wishes.

I hope this has been of help and has given you some insight into what Five Rules Homebuyers Should Never Break. Hire a great agent which you know will support your points of view and leave your friends and relatives to just that…friends and relatives. I wish you all the best to finding your new home.